Personal loans have become an important instrument for managing all financial demands in today’s fast-paced society, from unforeseen costs to planned investments. As the demand for these loans grows, it’s becoming evident that making wise decisions when it comes to borrowing money is critical.

This article dives into why comparing your options before getting a personal loan is a big deal. It shines a light on how this little practice can snag you better loan terms, sweeter financial outcomes, and a much sturdier financial future.

Let’s Get To Comparison Shopping!

- Knowing What’s What with Comparison Shopping

Comparison shopping is about weighing several options like MoneyTap and other apps before putting your money on the line. It’s like inspecting the goods to see whether they suit the bill and ensuring you get the most return for your dollar. It’s not only about going to the mall; it’s crucial while looking for a cash loan.

- The Hype Around Personal Loans

Everybody’s buzzing about personal loans these days, and it’s easy to see why. These loans are like chameleons – they can blend into various situations. Need to squash some debts? Renovate your crib? Fix yourself up after a medical curveball? Yep, personal loans got your back. But remember, not all cash loan offer equal benefits.

- The Power of Knowing What’s What

Picking the right personal loan isn’t just picking a random candy from the jar. If you choose the wrong loan, it’s like having a rain cloud follow you around. You’ve got to understand the deal – the rules, the interest, the fees. That’s how you keep your financial boat afloat.

The Star Power of Personal Loans

- Decoding Personal Loans

Personal loans are the aces of loans. You don’t need to hand over your bike as collateral – they’re unsecured. And you can use them for whatever tickles your fancy. So, if you want to have quick access to funds, Personal loans have your back.

- Real Talk – Why We Love Personal Loans

These loans are like the superheroes of finance. They swoop in when you’re hit with unexpected curveballs. They team up to tackle high-interest debts, handle medical surprises, and even fund your brainy escapades. When life throws punches, personal loans throw punches right back.

Playing the Interest and Term Game

- The Scoop on Interest Rates

Interest rates are like VIP passes for borrowing money. Even a teeny difference can change the game. It’s like choosing between a party with free snacks or one that charges for every chip.

- Getting Real About Loan Terms

Loan terms are like the roadmap for your loan journey. Short terms mean higher payments, but the long game might have you shelling out more in the end. Know the terms, and avoid plot twists.

- Big Picture on Interest Rates

Interest rates can be everywhere – blame it on the market or your credit mojo. Snagging a sweet interest rate means locking in a cozy financial future. And that’s where comparing kicks in – your golden ticket to stability.

Nailing the Comparison Game

- Get Your Detective Hat On

Start by searching around different lenders and what they’re offering. Collect all the goods – interest rates, terms, fees, pay later options and other benefits you might get. This detective work is the backbone of being a savvy shopper.

- Tech Wizardry

Online tools are like your comparison sidekick. Punch in the numbers, and boom! You get estimates for payments, total costs, and interest bites. It’s like a financial crystal ball.

- Friends, Family, and Money Gurus

Don’t be shy to tap into the wisdom of the people in your mission to find the perfect loan. Your professional space, your family, or that wise owl who knows their way around personal loans. They’re your secret weapon.

Checklist It Up

Make a checklist like you’re prepping for a groovy road trip. Note down what you’re looking for in a loan app like Smart Coin. It’s like your loan shopping map.

Comparison shopping is more than a chore. It’s like getting a backstage pass to a high-profile performance. Understanding your interest rates, conditions, and how it all affects your credit score? That’s equivalent to having the key to the city.

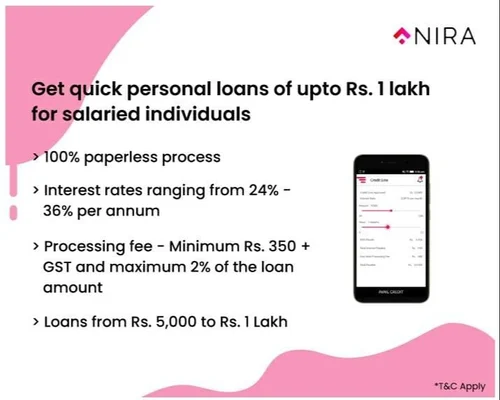

Spending that additional time researching loans is like having your financial cake and eating it too in a world where monetary decisions stay around for a very long time. So why not look into your lending options like Nira, MoneyTap etc. ? It’s not simply prudent; it’s also laying the groundwork for a secure financial future.