Understanding the Share Market is an important step for anyone looking to grow wealth over time. For new investors, the Share Market may appear complex, but learning the fundamentals can make investing more structured and goal oriented. With the rise of digital tools such as an all-in-one mutual fund app, investors today have better access to market information, portfolio tracking, and financial planning resources.

The Share Market allows individuals to participate in the growth of businesses while building long-term financial stability. Whether you are planning for future goals or exploring investment options through an all-in-one mutual fund app, learning how the Share Market works helps you make informed decisions with clarity and confidence.

What Is the Share Market?

The Share Market is a platform where shares of publicly listed companies are bought and sold. A share represents partial ownership in a company, and investors earn returns through price appreciation or dividends. When companies perform well, their share value may increase, benefiting shareholders.

For beginners, the Share Market serves as a structured environment where investments are regulated and transparent. It connects companies seeking funds with investors looking for growth opportunities.

How the Share Market Functions

Role of Investors

Investors purchase shares with the expectation of future returns. Their decisions are influenced by company performance, market trends, and economic factors. Long-term investors usually focus on steady growth, while short-term participants may focus on price movements.

Role of Listed Companies

Companies list their shares to raise capital for expansion, operations, or debt management. In return, they share ownership with investors and commit to transparency through regular disclosures.

Role of Market Regulation

The Share Market operates under strict regulations to ensure fairness and protect investor interests. Rules help maintain trust and prevent unethical practices.

Types of Share Market Investments

Equity Shares

Equity shares represent ownership in a company. Investors benefit from price changes and dividends. Equity investments are generally suited for long-term financial planning.

Mutual Fund Investments

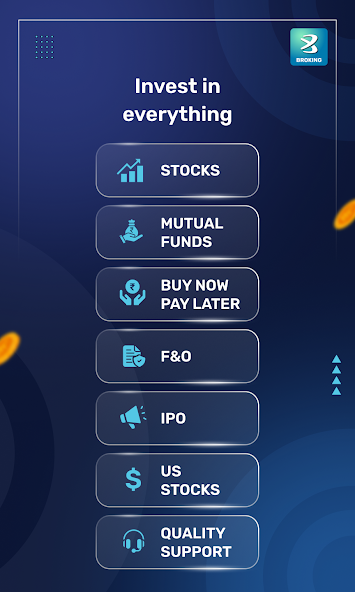

Mutual funds pool money from multiple investors to invest in diversified assets. Many investors use an all-in-one mutual fund app to track investments, monitor performance, and manage financial goals in one place.

Index-Based Investments

Index-based investments follow market indices, offering exposure to a broad range of companies. These investments reduce the risk associated with individual stocks.

Key Terms Every Beginner Should Understand

Market Price

The market price is the current value at which a share is traded. It changes based on demand and supply.

Portfolio

A portfolio is a collection of investments held by an investor. Diversifying a portfolio helps manage risk effectively.

Volatility

Volatility refers to price fluctuations in the Share Market. Understanding volatility helps investors remain patient during market changes.

Benefits of Investing in the Share Market

- Opportunity to build long-term wealth

- Access to diverse investment options

- Potential to earn returns above inflation

- Flexibility to invest according to financial goals

Using tools like an all-in-one mutual fund app allows investors to organize investments and review progress without complexity.

Risks Involved in the Share Market

While the Share Market offers growth potential, it also carries risks:

- Market fluctuations may affect returns

- Economic changes can influence share prices

- Poor investment decisions may lead to losses

Understanding risk tolerance and investment goals helps beginners navigate these challenges responsibly.

Importance of Research and Analysis

Fundamental Analysis

Fundamental analysis focuses on company performance, financial health, and future prospects. It helps investors evaluate whether a share is fairly valued.

Market Trend Observation

Observing market trends provides insight into investor sentiment and economic direction. Long-term trends often influence investment outcomes.

Long-Term vs Short-Term Investing

Long-Term Approach

Long-term investing focuses on holding shares for several years to benefit from business growth. This approach reduces the impact of short-term volatility.

Short-Term Approach

Short-term investing aims to benefit from price movements over a shorter period. It requires frequent monitoring and deeper market knowledge.

For beginners, a long-term approach supported by structured tools such as an all-in-one mutual fund app is often considered more stable.

Common Mistakes New Investors Should Avoid

- Investing without understanding the Share Market

- Making decisions based on emotions

- Ignoring diversification

- Expecting quick profits

Avoiding these mistakes helps build discipline and consistency in investing.

How Technology Supports Modern Investing

Digital platforms have simplified investing by providing access to real-time data, educational content, and portfolio management features. Many investors rely on an all-in-one mutual fund app to manage investments efficiently and stay informed without unnecessary complexity.

Technology enables better planning, regular monitoring, and improved financial awareness for investors at every level.

Conclusion

Learning the Share Market basics is essential for new investors aiming to build a strong financial foundation. By understanding how the Share Market works, recognizing risks, and adopting a disciplined approach, investors can make informed decisions aligned with long-term goals. The availability of tools like an all-in-one mutual fund app further supports structured investing by simplifying portfolio management and performance tracking.

With patience, continuous learning, and thoughtful planning, the Share Market can become a reliable path toward financial growth and stability.