Since the world was introduced to AI, it has become ubiquitous and has had a major impact on various different sectors and fields. Stocking trading is no different, it has made its way into stock trading as well. Although humans still play a significant role in stock trading, AI has become a important and irreplaceable part of it. In 2023, the AI trading market is valued at 18.2 billion, and it is expected to triple by 2033. But before we take a look at the trading techniques that AI uses in stock trading and day trading, let us understand what exactly AI trading is and how it works.

What is AI Stock Trading?

In simple terms, AI stock trading is the use of AI in stock trading. AI utilizes machine learning and predictive analysis to study and analyze stock data and the historic market to generate investment ideas, build portfolios, and automatically buy and sell stocks. Gone are the days when you had to visit the stock exchange to buy and sell stock; AI will automatically buy and sell stocks for you.

How does AI stock trading work?

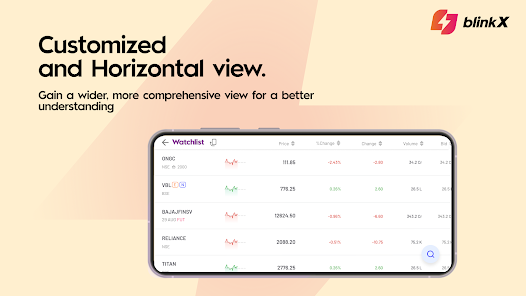

AI trading companies use different AI tools to monitor the ever-fluctuating stock market. They use AI tools to calculate price changes and why these price changes occur. AI also interprets the financial market and carry out sales and trades. This AI feature is now available on a stock market app as well, making stock trading much faster and convenient.

Types of AI Trading Techniques:

AI’s introduction to stock trading has truly changed the stock market landscape since AI can initiate and complete the trade on its own. But it’s not just that; there are other parts of the investing process that it plays a vital role in. Now that we have a much more clear understanding of what AI trading is and what role it plays, let’s take a look at the different trading techniques that AI uses:

- Sentimental Analysis:

It is an AI trading technique that utilizes natural language processing (NLP) to study various online resources such as social media, online newspaper articles, and financial blogs to understand the public’s sentiments towards a specific stock or the stock market as a whole. This technique aids the trader in understanding people’s feelings about the stock before investing in it.

- Data Mining:

This AI technique includes compiling and analyzing huge sets of data to spot trends or patterns that may be missed by humans. Here, the AI gathers historical data and extracts insights on previous stock market behavior. AI improves the data mining technique by enabling faster processing and complex analyses. This gives the traders an advantage and enables them to make smarter decisions.

- Risk modeling:

Here, the AI studies historical data to evaluate and assess potential outcomes and the risk associated with different trading strategies. Based on historical data, the AI weighs the different possible events that could occur. They also evaluate your current portfolio and adjust it if it is susceptible to common investment pitfalls.

- Predictive Modeling:

In this model, AI uses past data to predict potential future trends. AI has the power to process millions of transactions and analyze historical data, which helps it predict stock market behavior based on previous scenarios. The predictive model also improves the accuracy of forecasts and helps develop strategies that align with predicted market scenarios. This helps the trader make educated decisions.

- Real-Time analysis:

As we are all aware, the stock market is ever-changing, but AI shines at processing data quickly. With this ability, it can analyze data in real time. This helps traders act upon market movements, adjust their strategies, and take advantage of certain events before they become common knowledge—all in an instant.

- Back Testing:

Backtesting with AI allows traders to test a trading strategy on historical data and check its outcome before they try it out on the live market. This gives the trader an understanding of how the strategy would work in the past, which in turn improves their approach to the current market.

- Stress Testing:

Stress testing enables traders to test different hypothetical scenarios to determine how their investment strategies perform under extreme conditions. This helps spot the strategies’ weak points and better ensures their robustness against market downturns.

- Benchmarking:

Here, the AI weighs the performance of specific trading strategies against the established market benchmark. This helps evaluate the strategy’s possible success and understand how it stands in comparison to the broader market movement. It also helps traders plan their strategies better.

AI has revolutionized stock trading with these advanced techniques and tools. These techniques enhance decision-making, optimize strategies, and mitigate risks. As AI technology evolves, its role in investment apps India will grow, making it essential for traders to adopt AI-driven methods to stay competitive.