Digital payments have become the focal point of an unprecedented opportunity in today’s rapidly advancing digital landscape as the world undergoes a profound transformation towards a more interconnected and tech-savvy era. Traditional use of cash is gradually being replaced by cards, Scan and Pay methods.

This paradigm shift has given rise to a surge in instant pay, with the staggering estimate of nearly 420 billion transactions valued at $7 trillion projected to migrate from cash to cards and digital payment by the year 2023. The momentum is set to accelerate further, with Accenture’s estimation suggesting an astonishing $48 trillion transition by the year 2030.

This surge in individual payment is emblematic of a society that embraces convenience, efficiency and security in financial transactions. With the advent of mobile payment apps like Fampay, online banking systems and contactless payment technologies, consumers now have access to a plethora of smooth payment options at their fingertips.

The allure of digital payments lies in their ability to smooth transactions, simplify management and enhance the overall payment experience. That means you can add more in your savings accounts by using these methods.

At its essence, digital payment is a revolutionary concept that encompasses electronic transactions carried out via diverse platforms, such as mobile payment apps, online banking systems and contactless payment methods. And it’s unlike conventional payment methods, which rely on physical cash. Digital payments truly offer a smooth and secure alternative to transforming the way we conduct financial transactions.

Whether it’s mobile payment app or savings app both types of apps can be used to manage financial aspects, their primary purposes and functionalities differ. Mobile payment apps focus on transactions, while savings apps focus on helping users save and manage their money wisely. That means by using digital platforms you can manage money effortlessly.

One of the most compelling features of digital payments is the ease of tracking and managing your expenses. With a few taps on a smartphone or clicks on your computer, you can access comprehensive transaction histories, budgeting tools and spending insights. This real-time financial visibility enables you to make better choices, identify potential areas for cost-cutting and ultimately enhance your savings strategy.

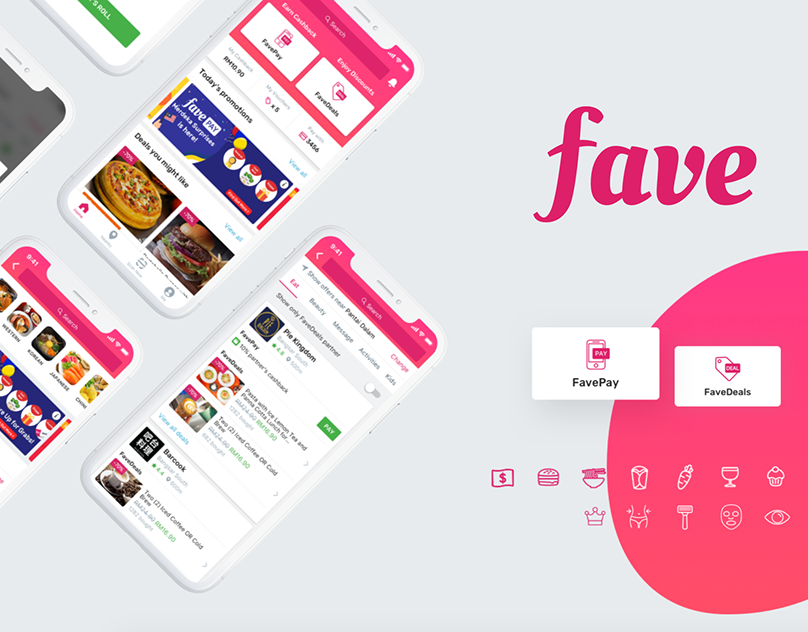

Digital payment platforms frequently offer enticing rewards and cashback programs as part of their package. When you conduct transactions through these platforms, you have the opportunity to earn valuable rewards points, exciting discounts or even receive instant cashback on your purchases.

These alluring benefits serve as powerful incentives and motivate you to hold digital payments more frequently. As a result, not only do you enjoy the convenience of cashless transactions, but you also unlock a path to effortless savings.

Digital payments also bring heightened security to your financial transactions. Advanced encryption and authentication measures protect your sensitive information. It will also reduce the risk that comes with carrying physical cash or using less secure payment methods. This advanced security fosters peace of mind, and with the help of this, you can focus on growing your savings and confidence.

The widespread adoption of digital payments has far-reaching implications for financial inclusion. As more individuals gain access to digital payment platforms, financial services become more accessible, particularly for unbanked or underbanked populations.

To sum up, the soaring growth of digital payments signifies a transformative shift in the way we conduct financial transactions. With its profound impact on convenience, security and financial inclusion, the rise of digital payments is reshaping the global payment landscape.