One of the best strategies to gradually increase wealth is by making investments and to invest in mutual funds are among the easiest and most accessible choices for people new to investing. Individuals can invest in an array of stocks, bonds, and other securities by pooling their money through mutual funds. In contrast to investing in your own equities, mutual funds offer an ideal way for beginners to get a taste of the financial world with less risk.

Reasons for investing in mutual funds:

The flexibility and diversity of mutual funds are the main reasons investing in them is a good idea. Professional fund managers oversee the allocation of investments across a variety of assets in mutual funds. By distributing your funds over several investments, diversification lowers risk and lessens the impact of negative performance in any one asset.

Mutual funds not only offer diversification but are also a practical choice for people who lack the time or knowledge to handle their own financial assets. You do not require to keep a close eye on the markets because asset purchases and sales are handled by qualified managers. Those with busy schedules or little experience can begin investing more easily with this passive method.

Various kinds of mutual funds:

Mutual funds are available in a range of formats to accommodate various investing goals. Among the most prevalent kinds are:

- Equity based mutual funds: These types of mutual funds are appropriate for investors seeking long-term capital growth because they mostly invest in stocks. Over time, equities funds provide larger returns, despite their tendency to be less predictable.

- Debt mutual funds: These kinds of investments are a more reliable choice for investors with conservative tastes who value consistent income over growth because they concentrate on fixed-income instruments like bonds.

- Hybrid mutual funds : Mutual funds that combine debt and equity investments in order to balance risk and return are known as hybrid funds.

It’s critical to assess your investing horizon, risk tolerance, and financial objectives before choosing a mutual fund

Advantages of using a mutual fund app:

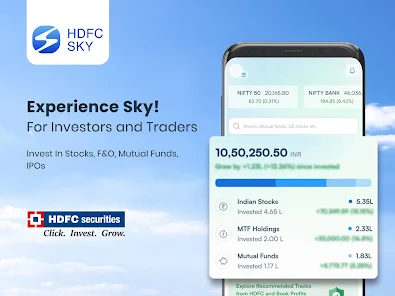

Investing in mutual funds is now easier thanks to technology. You can now easily manage your money investments from your smartphone thanks to the growth of financial apps. You can watch your portfolio, browse various funds, and make choices regarding investments whenever you want using a mutual fund app.

To assist you comprehend the different kinds of mutual funds, such as debt, hybrid, and equity funds, different mutual funds applications also provide educational materials. Through these platforms, you can locate a fund that aligns with your objectives, whether they are steady income or long-term growth. Furthermore, setting up regular contributions is simple with a mutual fund app, allowing you to steadily increase the amount you invested without having to think about it.

How to begin your investment adventure?

It’s now simpler than ever to begin investing with mutual funds. Using a mutual fund app, the procedure may be finished in a few simple steps, and many platforms enable you to start with a modest initial commitment. You must choose the kind of fund you wish to invest in, determine your investment amount, and create your account.

Keep in mind that to invest in mutual fund is not a way to make rapid cash. It’s a long-term approach meant to gradually increase your wealth. You may maximize the value of your mutual funds and reach your financial objectives by maintaining consistency in your investments and routinely assessing your portfolio.

Conclusion:

If you’re looking for a reasonable and reasonably safe way to start growing your money, it’s time to begin investing in mutual funds. Mutual fund apps have made investing easier than ever before. Whether you choose debt, equity, or hybrid funds, these mutual funds offer a flexible approach to portfolio construction that can be customized to meet any financial goal. Invest now to control your financial future!